they are fostering for a recognized charity or shelter!!

If You Foster a Cat Or a Dog In California, You Can Now Claim it On Your Taxes

If You Foster a Cat Or a Dog In California, You Can Now Claim it On Your Taxes

for you! It's funny - - we met our tax preparer when she adopted two little kittens brothers we fostered - - and she's never mentioned this to us. You'd think she'd have told us at least?!?!

for you! It's funny - - we met our tax preparer when she adopted two little kittens brothers we fostered - - and she's never mentioned this to us. You'd think she'd have told us at least?!?! ) told us about that deduction, and we deducted quite a bit bc of all of the fostering we did!!!!!!"

) told us about that deduction, and we deducted quite a bit bc of all of the fostering we did!!!!!!" ) - I'd check with your tax preparer first. Everything I'm seeing does say it was a national rule put into place in 2012.

) - I'd check with your tax preparer first. Everything I'm seeing does say it was a national rule put into place in 2012. for your tax questions).

for your tax questions).  It’s frustrating for those of us who want to help by supplying certain things. So far, my tax preparer says I cannot take deductions. Maybe that’s changing. Maybe I need to move to California!!

It’s frustrating for those of us who want to help by supplying certain things. So far, my tax preparer says I cannot take deductions. Maybe that’s changing. Maybe I need to move to California!!Good to know. I’m wondering if our state just requires the care be provided through the actual group who holds the 501c3 status. I’ll be rechecking that.Well - color me embarrassed! (I couldn't come up with a better phrase there - sorry) I just went in and told my hubby about this, and he said - "don't you remember? (I obviously did not) Our tax woman (he didn't call her that I just didn't want to put her name out there) told us about that deduction, and we deducted quite a bit bc of all of the fostering we did!!!!!!"

So - my bad - she did know. And yes - looks like it is national!. Although anyone who's reading this (besides you -catsknowme - and me

) - I'd check with your tax preparer first. Everything I'm seeing does say it was a national rule put into place in 2012.

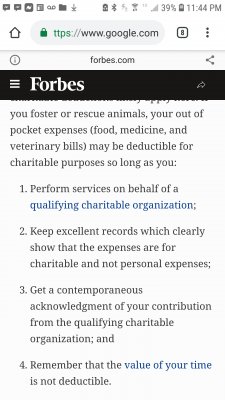

Here are 2 links with a bit more about what's deductible (again though - check w/someone who's NOT a graphic designerfor your tax questions).

Tax Deductions for Fostering Dogs and Cats - Michelson Found Animals Foundation | Pet Adoption, Microchipping, Spay & Neuter

Foster Pet Tax Deductions

)

)